The Fall and Rise of Uranium

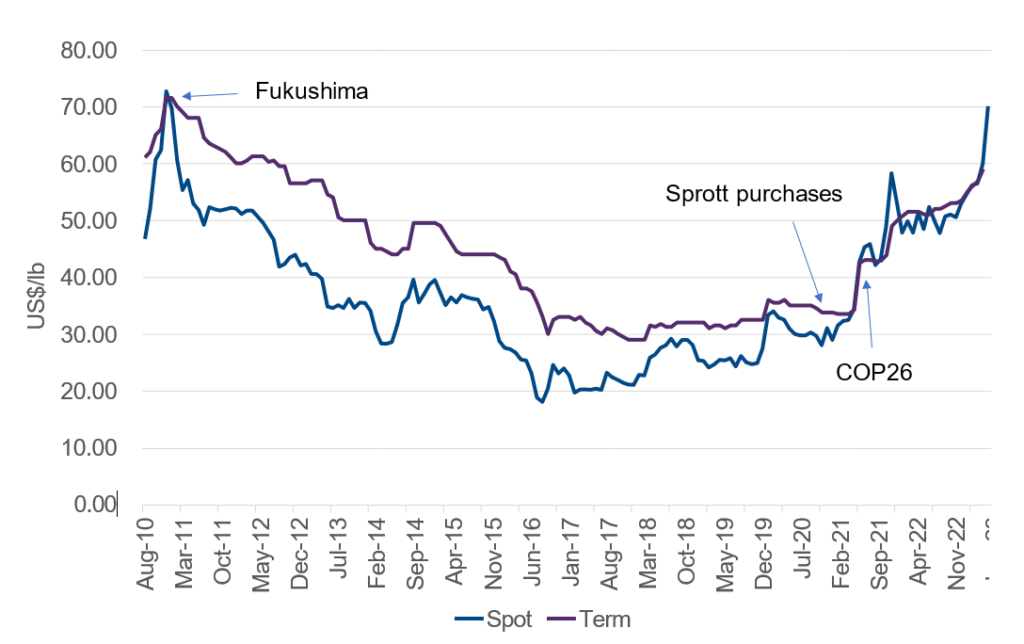

The nuclear industry is undergoing something of a renaissance. For anyone with an interest in the industry, even a passing one, it’s been a painfully long wait, but the uranium worm certainly seems to have turned. Over the past 12-18 months, we have added positions in Boss Energy (BOE.ASX) and Paladin Energy (PDN.ASX), two uranium miners. At the time of writing, the uranium spot price had topped US$70/lb, a 13-year, pre-Fukushima high and contracted volumes are on the up. In that time there has been more than one surge in the commodities sector, but uranium has missed out every time. So how did we get here?

The Fall

Not much moves quickly in the nuclear industry. The last time we experienced this level of positivity, one of our team was on site at Paladin’s Langer Heinrich (LH) uranium mine in Namibia. That was in early 2011 during the Stage 3 expansion (see above). The mood then had turned bullish even though the uranium price had peaked three years earlier at over US$130/lb.

Most commodities overshoot and that was certainly the case with uranium in 2007 as phenomenal Chinese growth erased a decades long malaise in uranium. However, over the next three years, the price did not dip below US$40/lb and exceeded US$70/lb around the time of that LH site visit – about where we find ourselves now. Prices were high, the mine was expanding, and uranium was being hailed as a natural alternative to coal for reliable baseload, driven by a “green energy” tailwind. What could go wrong?

An earthquake. And an unusually big and complex one at that. It struck the east coast of Japan in March 2011, just a handful of months after that LH site visit. At magnitude 9, the so-called Great East Japan Earthquake was the largest in Japan’s history and the fourth largest recorded since the advent of modern seismology, 110 years earlier. In other words, this was a very rare event.

The earthquake and resulting tsunami disabled the cooling systems of the coastal Fukushima Daiichi Nuclear Power Plant, resulting in core meltdown in three reactors. While the Daiichi plant, which first began operating in 1971, was able to withstand the ground movement produced by the quake, it was not designed to cope with the 15m tsunami that followed.

Unfortunately, the engineers had used a 1960 Chilean earthquake and its resultant 3m tsunami to design some of the safety systems at Daiichi. The plant’s 10m elevation should have allowed plenty of room for a “regular” tsunami but proved to be inadequate on this occasion as no-one anticipated the magnitude of this event. In short, Japan’s nuclear industry, which accounted for ~30% of the country’s electricity generation, shutdown in a nationwide safety review, whilst a pall was cast over the global industry that would last a decade.

A long, dark winter

Fukushima’s impact on the global nuclear industry cannot be underestimated. For example, following the accident, Germany immediately shutdown eight of its 17 reactors and committed to close the remainder of its fleet, the last of which occurred in April 2023. Prior to the disaster, nuclear energy accounted for one-quarter of Germany’s electricity production.

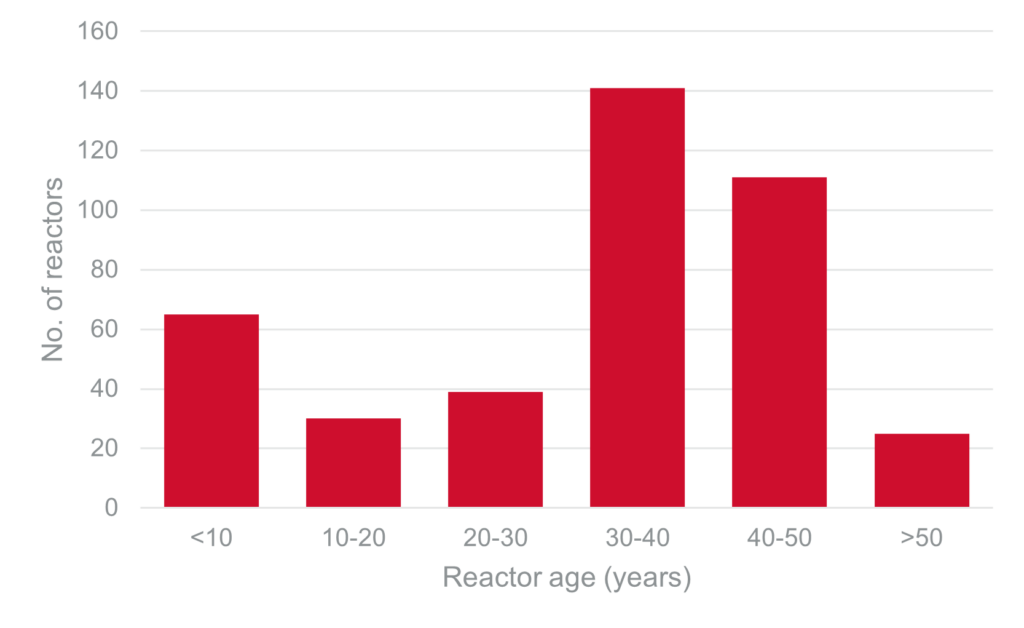

Overall, global electricity production from nuclear dropped 11%. Justifiably, fear of further accidents at older reactors and the increased cost of upgrading/replacing to newer, safer designs, impeded growth of the industry. Furthermore, sentiment was greatly impacted by the potential of renewables – would nuclear even be needed as baseload if windmills and solar panels could deliver zero-carbon power? On the supply demand side, Kazakhstan, the world’s biggest producer of uranium, was ramping up production at the time of Fukushima, and continued to do so beyond the shutdown of the Japanese industry.

To compound the problem, Canada’s Cameco commenced full-scale commercial production at the underground Cigar Lake in May 2015. The eventual commissioning was complex and protracted. Development had started a decade earlier, but a series of water inflows flooded the mine (it’s not called Cigar Lake for nothing). At the bottom in October 2016, the spot price of uranium dipped to US$18/lb and it would be another four to five years before market would stir.

The Spring

We can probably trace the start of the current “boom” to mid-2021 when Canada’s Sprott Asset Management founded its Sprott Physical Uranium Trust (SPUT), a physically backed financial product. Its purchases helped soak up excess market supply within a gently improving backdrop for nuclear energy. This enthusiasm was shortly followed up at the COP26 meeting in Glasgow, Scotland, later that same year, where nuclear energy again featured as a low-carbon alternative to coal baseload power but arguably with more urgency.

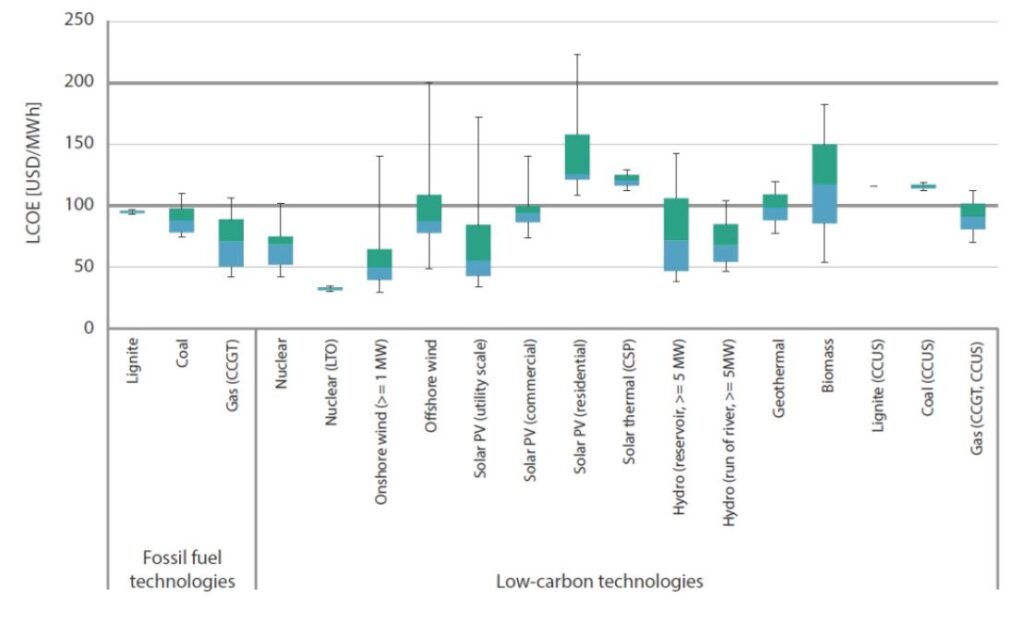

It is increasingly apparent that net-zero by 2050 solely from renewables is extremely challenging and nuclear power represents one low-carbon way to fill the gap. In terms of power generation, nuclear energy offers several advantages over traditional baseload. Nuclear utilities are very long-life assets, land use is 30-100x less than other low CO2 options, CO2 emissions/kWh are lower than all other power sources except for wind, and life extensions of nuclear power plants represents the lowest cost low-CO2 energy.

Other factors have combined to add upward pressure to the uranium price. For example, in the US, the Inflation Reduction Act (Aug 22) provides tax credits and development incentives for existing reactors and uranium resources, while the DoE commenced purchases for its Federal Strategic Uranium Reserve (Sept 22). Elsewhere, nuclear energy has been included in the green energy taxonomies of the EU, UK and South Korea. In geopolitical terms, there is clear uranium (and gas) supply risk around Russia following the invasion of Ukraine and the coup in Niger, the world’s sixth largest supplier, has caused consumers like France some concern.

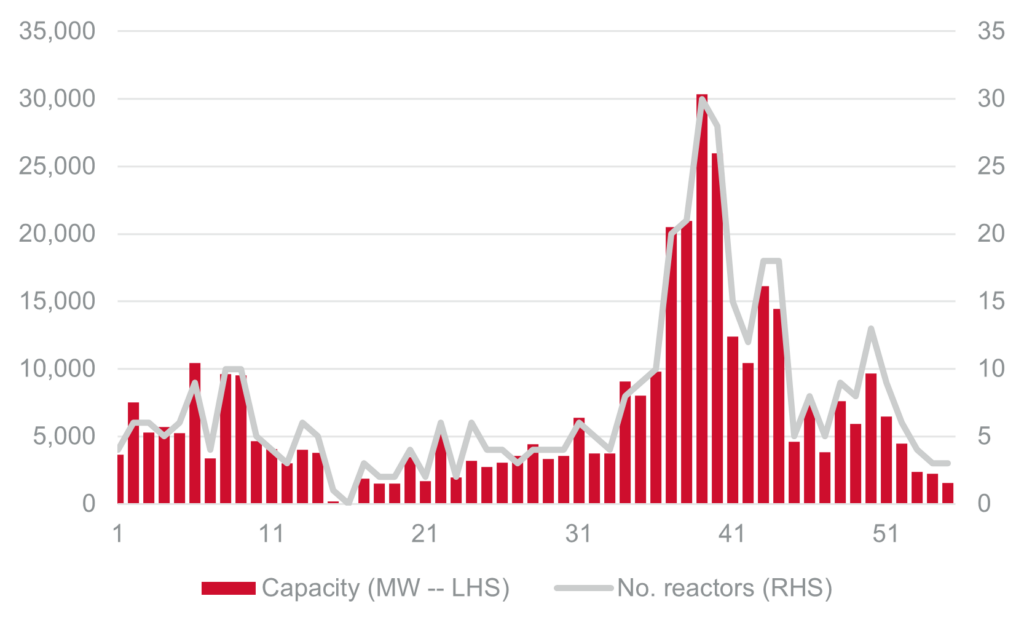

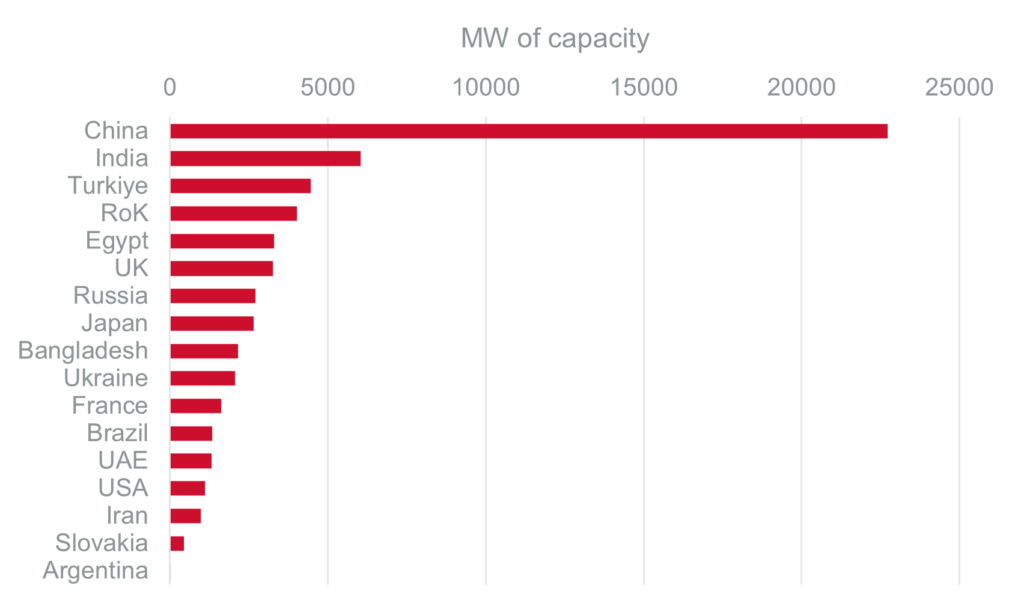

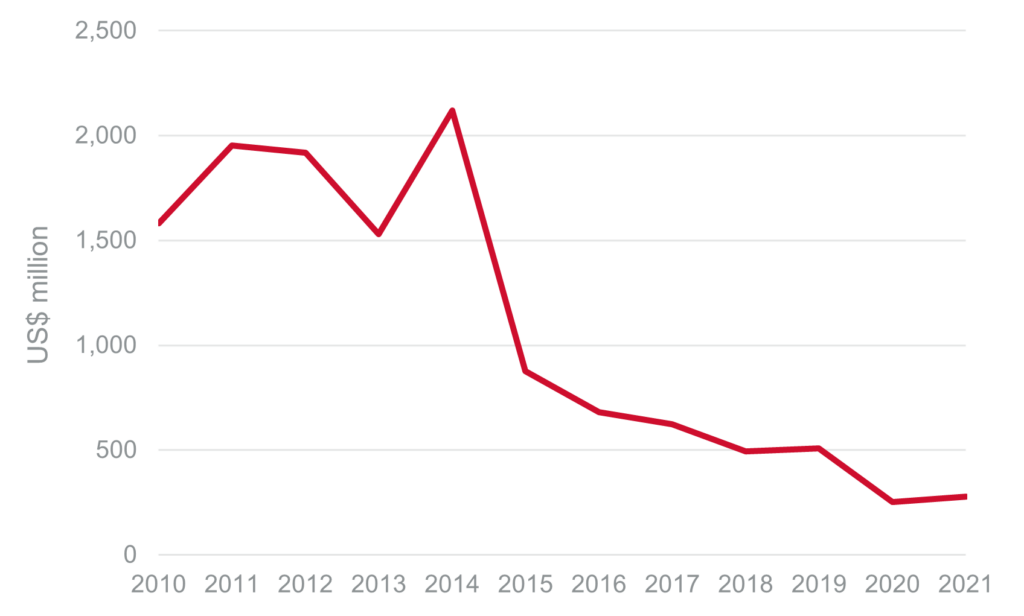

From a capital point of view, we are seeing increased investment in nuclear power from Asia in particular (see above). On the supply side, uranium exploration and development has plummeted and remains at multi-year lows. While the uranium market is a closed and esoteric one that can be difficult to decipher, there is incremental benefit in the short-term from this supply-demand dynamic.

Where to from here?

While the outlook for the uranium market is better than it has been for more than a decade, challenges remain. Nuclear energy is still a divisive issue due to ever-lingering safety concerns, and it could be argued that countries like Australia may never see its use. Other factors that impede acceptance include the upfront cost of construction, strict regulation and the time to build a new plant, where the median time is currently around 80-90 months.

On the flip side, nuclear facilities are amongst the most rigorously engineered structures on Earth and provide very long life, consistent output. While upfront capex is very high, the levelized cost over the life of a nuclear asset is extremely competitive especially if life extensions to existing plants is considered. Moreover, new technologies, such as Small Modular Reactors (SMR) offer potential advantages in cost and safety. Finally, recent geopolitical developments such as the Russia/Ukraine conflict highlight the need for secure, reliable sources of power. In a world focused on low carbon electricity, it is not surprising that many nations are considering a nuclear future.

Author: David Haddad, Principal and Portfolio Manager